Donation Tax Calculator

NUS has Institution of a Public Character (IPC) status. Cash donations made to an approved IPC, such as NUS, for causes that benefit the local community, are deductible donations, pursuant to Singapore Income Tax regulations.

From now till 31 December 2023, Singapore tax residents who have made a donation to NUS will receive a tax deduction of 2.5 times the donation value. To qualify for tax deduction, all donors are required to provide their Tax Reference Numbers (NRIC/FIN/UEN) when making the donation.

Example of impact on taxable income from an NUS donation

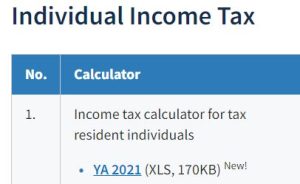

To calculate your individual net income tax payable from making a donation, follow these simple steps:

2. After filling in your income, personal reliefs, and rebate(s), enter your donation amount (multiplied 2.5 times).

E.g if you have donated $100, enter $250 (2.5 x $100).

3. Check your net tax payable, which will be automatically calculated.

You do not need to declare the donation amount in your income tax return. NUS will transmit electronically the details of your donation to IRAS. Tax deductions for your qualifying donations will be automatically reflected in your tax assessments based on the information from NUS. IRAS will no longer accept claims for tax deduction based on donation receipts.

Disclaimer: The above information has been extracted from the Inland Revenue Authority of Singapore (IRAS) for Year of Assessment (YA) 2021. Please visit iras.gov.sg for more information.